It starts the moment that you book your cruise. That low headline cruise fare suddenly doubles when two people are added… is bumped up with things like port taxes and fees… and even more money with the addition of gratuities.

Once on the ship plenty of things are free, but you are expected to pay for extras ranging from soda to alcohol to shore excursions.

You are also bombarded with sales messages while on board. Art auctions, spa specials, and slot tournaments are just a few of the things that cruise lines pitch to passengers.

With all that, you can sometimes feel like you are spending a fortune on your cruise. In addition, it may seem like the cruise line must be raking in massive profits. But is that true?

That why we just dug through the financial reports of one of the world’s biggest cruise companies — Royal Caribbean Group. We wanted to give you a better idea of exactly how much money people spend on a cruise ship and how much profit the cruise company makes when it comes to each individual passenger.

How Much Passengers Spend Per Person

How can we find out how much passengers spend… and where it goes?

As a public company, Royal Caribbean Group (just like rivals Norwegian Cruise Line Holdings and Carnival Corporation) makes regular financial updates to investors.

These reports provide insight into the business of the company, which is parent to the popular Royal Caribbean brand, as well as Celebrity and Silversea. While the reported figures aren’t broken down by cruise line, they do give insight for the company as a whole.

In 2024, Royal Caribbean and its cruise lines carried 8.56 million passengers on its ships located around the globe. In total, those passengers generated $16.48 billion in revenue for the company during the course of the year.

In other words, for every passenger Royal Caribbean carried, the average passenger spent $1,926 with the company last year. This figure includes everything from cabin fares to buying drinks to souvenirs in the gift shop.

Of that $1,926, 69.8% ($1,344 per passenger) was spent on cruise fare and the remaining 30.2% ($582 per passenger) was spent onboard for everything from booze to t-shirts in the gift shop.

Where the Money Goes to Operate the Cruise

Now, it goes without saying that all that money being spent on cruising doesn’t make it to the bottom line as profit. After all, cruise lines run major expenses, starting with the cost of the ship itself. Then there is the cost of all its employees, food, and even fuel to get the ship moving. That’s to say nothing of expenses like marketing and commissions to travel agents.

Royal Caribbean Group identifies numerous different groups of expenses in its financial statements, presented below in their own words:

Our cruise operating expenses are comprised of the following:

- Commissions, transportation and other expenses, which consist of those costs directly associated with passenger ticket revenues, including travel advisor commissions, air and other transportation expenses, port costs that vary with passenger head counts and related credit card fees;

- Onboard and other expenses, which consist of the direct costs associated with onboard and other revenues, including the costs of products sold onboard our ships, vacation protection insurance premiums, costs associated with pre- and post-cruise tours and related credit card fees as well as the minimal costs associated with concession revenues, as the costs are mostly incurred by third-party concessionaires, and costs incurred for the procurement and management related services we perform on behalf of our unconsolidated affiliates;

- Payroll and related expenses, which consist of costs for shipboard personnel (costs associated with our shoreside personnel are included in Marketing, selling and administrative expenses);

- Food expenses, which include food costs for both guests and crew;

- Fuel expenses, which include fuel and related delivery, storage and emission consumable costs and the financial impact of fuel swap agreements; and

- Other operating expenses, which consist primarily of operating costs such as repairs and maintenance, port costs that do not vary with passenger head counts, vessel related insurance, entertainment and gains and/or losses related to the sale of our ships, if any.

In addition, the company has depreciation and amortization expenses and marketing, selling and administrative expenses before it arrives at its operating income. Operating income is the money the cruise company makes in the day-to-day operation of its business.

Before arriving at net income (profit), one more category must be factored in — other income and expenses. This includes thing like interest income and more importantly for cruise companies, interest expense.

With the pause in sailing during the pandemic, cruise companies like Royal Caribbean Group took on billions in debt to survive. Now, they are paying these loans back aggressively.

How Much Cruise Lines Profit Per Passenger

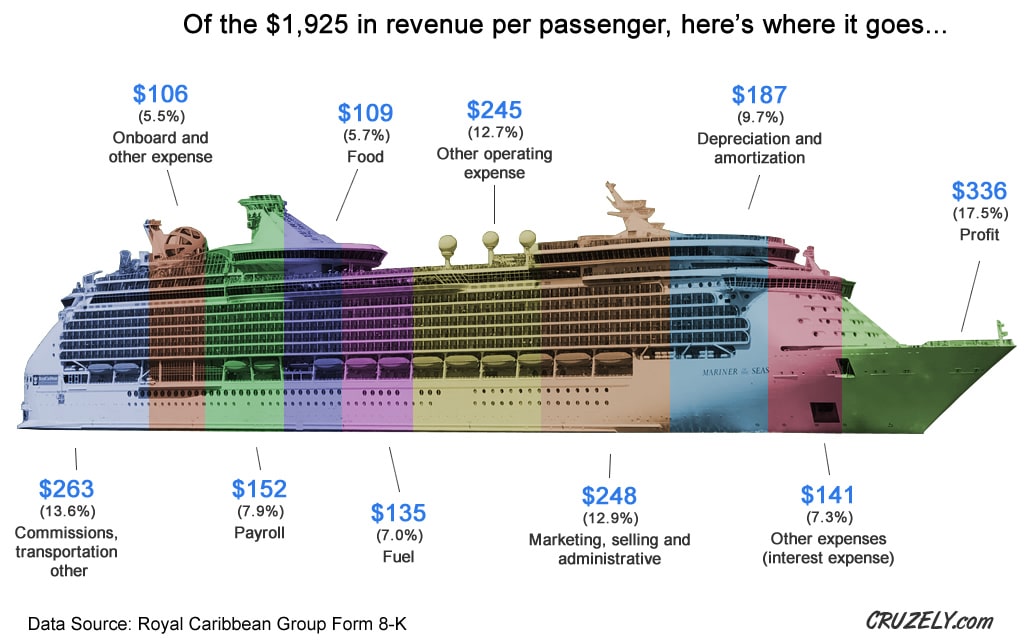

All told, these costs eat into revenue, but there is still a healthy profit. How much so? Of the $1,926 in revenue generated from each passenger, 17.5% — or $336 — ends up as profit.

Below, we’ve broken down all the expenses the cruise line sees on the average fare per passenger (click to enlarge):

As you can see, a healthy portion of the money taken in by Royal Caribbean still goes down to the bottom line. All told, last year saw a profit of $2.87 billion — or $7.95 million per day — before adjustments.

If you’re a shareholder, however, it’s been anything but smooth sailing. Consider that in 2022, the net income loss totaled more than $2 billion, on top of billions lost during the pause in sailing. With cruising back and seemingly more popular than ever, the healthy profits today are a welcome sight to the industry.

Source: Royal Caribbean Group Form 8-K. January 2025

Popular: 39 Useful Things to Pack (17 You Wouldn't Think Of)

Read Next: Park & Cruise Hotels for Every Port in America

Popular: 107 Best Cruise Tips, Secrets, Tricks, and Freebies

Well, I don’t buy alcohol, cigarettes or gamble, so their profit percentage on me is probably in the negatives LOL

This is so well presented and easy to understand.

Thank you for taking the time to frame it this way.

I would like to know how long does it take for a cruise ship to recoup the cost to build the ship, roughly 850,000 to 1.5B? Obviously, there are many factors to consider including how many passengers the ship will hold and what amenities must be offered (or not) to get people willing to pay for the passage? And what would that ticket price be?

Question; are people willing to go back to paying passage for a FAST luxury liner (3 days from US to Europe) to avoid the cramped, bacteria, germ-filled ventilation in close quarters of a jet plane? I used to like to fly, but not anymore!

Would passengers be willing to pay more for the experience to travel on a historic ship that is presently derelict but still holds the record for fastest time crossing the Atlantic? Do people have to have a “Disney Land” experience on every ship or would people be willing to pay to relive the heyday nostalgia of a cruise liner with today’s 5-star, first-class amenities? I ask these questions in reference to bringing back the SS United States docked in Philly since 1969. I for one would prefer to set sail on such a ship over the “carnival” most all ships offer.

I always tell our Cruising Customers that a Cruise is a WHOLESALE vacation. Cruise lines make NO profit (do the math) on the BASE cruise fare. Their profit is all the other “stuff” – that 28% extra.

So….. If you don’t drink, buy gifts, do specialty dining, take shore excursions, you get a DEAL. And I am MOST happy with the people who DO make these purchases, and they subsidize MY Cruise Vacation

I think the actual profit must be higher than 8%. Royal Carribean have hired a good accountant in order to minimise their official profits and therefore taxes paid. Investors regularly make 10% with a mixed portfolio. You would think the actual figure must be higher to justify the effort and risk involved.

This was from a recent annual report. It could be higher or lower in more recent reports. We plan to take another look in the future.

On The Royal Caribbean 3-day cruise to Bahamas that we just came from, it seemed like we spent quite a bit. It seemed like they must be making a lot.

I took an 11 Baltic Cruise with Princess. The cruise was free of charge as an offer for giving up a 7 day cruise of south Japan. The cruise fare was advertised at $4600.00 CDN pp. When we received our statement for the Baltic Cruise, it included the base fare and extras we booked re: shore excursions, gratuities etc. The base fare was $2600.00 pp! That is $4,000.00 ($2000.00pp) less than the advertised price that we would have paid if not for the ‘Move-over-offer’ That equates to a profit of over 40% on the base price (not including the profits off alcohol, excursions etc.). The Royal Caribbean stat. of 8% sounds ridiculous.

Very cool. Thanks for taking the time to research this.

8% is good but it’s also not true. They are making much more. The ships are tax havens or are put in onshore schemes that pretty much make them tax free (less than 1% in annual tax). The deprecation is also used to offset any taxes that may have been applicable so that’s a lot to keep profits above 8%.

Dan, the data comes from financial reports filed with the SEC.

8% is a pretty healthy profit margin – higher than I would have expected.